The coffee market will have to deal with the effects of COVID and the trends that characterized the pandemic period for a long time to come. Indeed, the latter could become even more pronounced in light of Italians’ new purchasing and consumption habits. These are the outlooks of industry analysts toward a sector that has seen pods and capsules undermine the primacy of mocha.

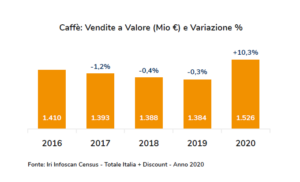

To better understand the trends in the coffee market, it is necessary to have a broader view of the category, observing its performance in Modern Distribution (hypermarkets, supermarkets, local chain stores, and discount stores) in the years preceding the spread of COVID-19, according to IRI data.

Before the pandemic, the market was in a slowdown phase, and promotional levels had reached very high peaks. In 2019, 51% of volumes were sold under promotional conditions, a percentage that reaches 56% in the ground coffee segment. The success of capsules has led to the evolution of consumption habits and has channeled, at least in part, purchases to the online channel, specialty, and proprietary brands.

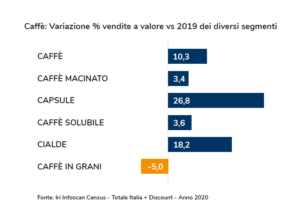

As already highlighted, 2020 changed the game:

- The pandemic brought consumption back within the home and effectively eliminated the out-of-home world

- The market grew by double digits (+10.3% in value)

- Promotional pressure was reduced (-3.6 percentage points in volume vs. 2019)

- The price per kg increased by almost 7 percentage points

Consumer Behavior Changes

De’Longhi and Nielsen researched how Italians’ habits changed over the past year regarding coffee consumption: smart working and pandemic-related restrictions limited access to bars and restaurants and increased the daily average of coffee consumed at home (from 1.9 to 2.4).

79% of respondents agreed to spend more to enjoy good coffee at home, and 64% of the sample dedicated themselves in the past year to work or purchases to improve their living space, particularly the kitchen. The concept of “at home like at the bar” led eight out of ten Italians to say they were willing to spend more to enjoy a quality product.

The AstraRicerche survey, conducted on behalf of the Coffee Promotion Consortium, explored Italians’ relationship with their favorite hot drink.

The survey was conducted through online interviews on a representative sample of 1,000 individuals, aged between 18 and 65 years, updating the snapshot of Italians’ consumption habits created by AstraRicerche in 2014.

The survey confirms the almost unanimous love of Italians for coffee, despite the change experienced nationally and globally with the COVID-19 emergency and the consequent lockdown. From the survey, it emerges that the pandemic and forced isolation represented experiences that took away from Italians an important part of their daily routine: 60.3% missed the ritual of coffee at the bar.

In particular, what was missed was a pleasant routine at the beginning of the day, meeting with friends, and the taste of coffee prepared at the bar. Not only that: an even higher percentage, equal to over 65% of workers and students, also suffered from the absence of the coffee break in the workplace or study place.

To respond to this trend, brands have positioned new specialties on the shelf, increasing the offer of premium products (hence the price increase per kg), making them also available on Amazon: what better showcase for these new consumers who have approached and love online shopping.

Broadening the horizon of analysis data compiled by IRI on consumer packaged goods reports a growth in value of e-commerce driven by Amazon, of 111 percent (about consumer packaged goods), an increase that is continuing into 2021, albeit at a slower pace (+80 percent).

The factors that determined such growth also concern the advantages connected both to online product purchases and to the characteristics of the products themselves. Pre-packaged coffee pods are extremely practical: they allow obtaining a portion of beverage in a simple and fast way.

Alongside pods and capsules, interest in espresso machines has also grown, increasingly flanking the traditional moka pot. The ability to carefully control the characteristics of pods and capsules, including the list of compatible machines, represents another incentive for online purchases, precisely on Amazon.it.

The most searched subcategory on Amazon.it is confirmed to be dedicated to “coffee pods and capsules” intended for home consumption, which represents over 20% of the estimated search volume in the “Coffee, Tea and Beverages” category in the first half of 2021.

It should also be noted that after 2020, of generic category searches, we are returning in 2021 to brand keyword searches, with over 50% of total searches.

This push in capsule sales has opened a new table of competitiveness for companies: the green challenge. This is, as already commented for other categories analyzed, a general trend that finds particular evidence in Amazon searches linked to green–bio–eco–sustainable, to which companies, top sector players in the lead, are responding with compostable and compatible capsules and pods, search keywords that are positioned within the 80k most searched terms.

Some of the trends identified from the analysis of this market are common to other grocery sectors and will become part of consumer routine: such as attention to health, the search for naturalness and well-being as synonymous with product quality, the tendency to concentrate spending by making planned purchases aimed at stocking, the choice of high-end products precisely because consumers want a valid alternative, even for breakfast that they previously enjoyed outside the home.

Roberto Botto. Ceo di Inthezon, società di Libera Brand Building Group

Note: The content of this report is the result of independent evaluations by Inthezon and not by Amazon or brands attributable to it.