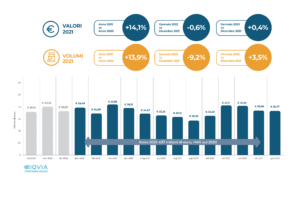

The COVID-19 pandemic and its aftermath have impacted consumers’ propensity to purchase pharmacy products. Data from IQVIA, the global provider of health and pharmaceutical data, innovative technologies, and clinical research services, show that in 2021, the online pharmacy market experienced a 14 percent increase in its sales. In absolute terms, total online drug sales increased from 383.1 million in 2020 to 437.3 million in 2021. If we compare this latest figure with that of 2019, the increase is even more pronounced, as the figure for the last year before the pandemic outbreak, online drug sales was 229.6 million.

Considering that only commercial products can be sold online in Italy and not products from the ethical sector, the market share of e-commerce sales in 2021 was about 4 percent of the total. But the figure that stands out above all concerns the progression: in the two years of the pandemic – that is, 2019 vs. 2021 – online grows at values of 90 percent, while in the physical sector, the total pharmacy turnover (including ethical) grows in the same period by only 1.5 percent.

The macrocategories of products showed strong increases. Notified supplements (vitamins, minerals, probiotics, hair and nail products, etc.) had total sales of 215.2 million, up 17 percent from 2020. The personal care segment (cosmetics, creams, shampoos, etc.) recorded online sales of 141.3 million, up 12.3 percent.

Self-medication drugs increased their sales by 7.7 percent to 45.0 million euros. The medical devices category, which includes masks, oximeters, thermometers, etc., had sales of 141.3 million euros with an increase over 2020 of 12.3 percent. Lastly, nutritional products (powdered milk, celiac food, etc.) increased by 17.7 percent to 12 million euros.

Also of undoubted interest is the evidence derived by shifting the analysis from baskets to individual categories: the first market segment by value of online sales is women’s beauty, which in 2021 totaled a turnover of 59.6 million euros (+13.8% over 2020). They are followed by vitamin and mineral supplements, which end the year at 52.7 million (+15.3%), and at a good distance by over-the-counter analgesics (21.5 million euros, +17.4%). Closing in negative territory was only the cough and cold products segment (20.5 million euros, -1.4%), but it should be kept in mind that in 2020, this category had put up 127% over 2019.

In general, the Covid-19 pandemic has brought a sharp increase in the average number of pharmaceutical/parapharmaceutical products purchased, and the trend became clear during the two main shopping events on the Amazon platform: Prime Day and Black Friday, which provide us with an accurate mirror of the most sought-after references. Starting with Prime Day (June 20 and 21), in fact, in the vast assortment of references in the consumer health compartment, alongside “covid products” (cleaners, disinfectants, masks and oximeters), interest in preventive-type products, such as supplements and vitamins, have begun to assert themselves, accounting for more than 1 in 3 (34%) purchases during the last Black Friday.

But who are the Italian buyers of health products and services, both online and through traditional channels?

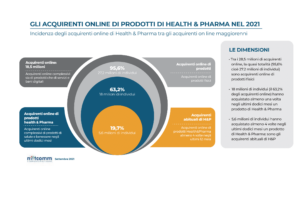

The report “Consumer research on online purchase of pharmaceutical and health products,” conducted by the Netcomm digital health & pharm working group and published last fall, highlights a much more mature consumer profile in 2021 in the use of digital channels. In summary, not only is online spending increasing, but about 35 percent of e-shoppers already have an e-commerce referral.

In total, about 1.5 billion health products were purchased online in 2021 alone. Approximately 5.6 million individuals purchased Health & Pharma products online at least four times in one year.

Regarding the demographic profile of H&P e-shoppers, in an early stage of the phenomenon’s evolution, regular buyers of drugs and health products show a higher concentration in the middle age groups, between 45 and 54. Now this dynamic is no longer observed, and the age profile of online category buyers is significantly younger, with a high concentration in the 25-44 age group.

A final element to examine is the composition of users who choose to use pharmaceutical e-commerce. Data from eFarma by Atida shows a female predominance among consumers, with a significant growth in 2021 (62 percent) compared to 2020 (51 percent). Related to this, it is interesting to note that the second most popular product category on the Amazon platform after supplements and vitamins is cosmetics (21%).

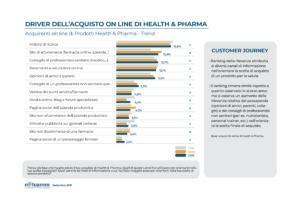

At the same time, being a historically “physical shopping” category, the consumer still gets guidance and advice from the pharmacist or a parapharmacist. This online “presence” is difficult to offer.

And once again, it has been Amazon that has established itself as a point of reference for companies, even small ones, because of the relative ease of activation, the possibility of accessing it with less investment than setting up a direct online sales channel. , where they can improve their positioning and sales performance, exploiting all available levers: from content optimization, creating very accurate and in-depth product sheets, and creating real virtual stores to create a direct relationship with consumers and answer all their questions.

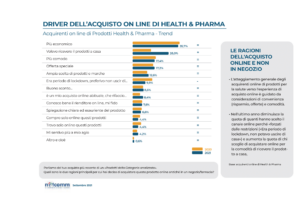

The path to purchase in pharma is very articulated and sees the use of different touch points, on and offline, particularly in the stages prior to purchase. The search engine is confirmed as the first touch point, and there is an increase in the relative relevance of word of mouth (opinions of friends, relatives, colleagues) and advice from non-health professionals (e.g., nutritionist, personal trainer, etc.) in guiding the final purchase choice.

Finally, about the levers that drive consumers to turn to online for their healthcare purchases, Iqvia puts price first, which also weighs in because of the ability to compare products, offers, and discounts online. But other factors, such as the confidentiality that characterizes online purchasing and the convenience that comes from being able to shop 24 hours a day, seven days a week, are also increasingly decisive. And without having to leave the house.

Those who buy online also tend to develop a mechanism of trust with the seller, whether merchant or platform. In this context, trustworthiness is a key determinant for one’s business development.

Italians, and particularly those who buy H&P online, already seem accustomed to using digital health services. The most used and popular service is the ability to choose and book a visit or prescription at a facility through an online booking service. This is followed by Apps dedicated to the patient’s health status and chats with the specialist. Video consultation (i.e., the ability to have a consultation with a specialist remotely via a video call) is a service already being used by one in five online shoppers.

Meanwhile, as early as late 2020, Amazon Pharmacy, which allows users to order prescription drugs, started in the US. Shoppers can pay using their health insurance, through a secure profile, and Amazon Prime service members who do not use insurance are eligible for discounts on generic and brand-name drugs on the site or at the service’s approximately 50,000 participating pharmacies.

Amazon will show the price both when using insurance and without. The service also does price comparison of medicines, and delivery is guaranteed completely free within two days to those with Amazon Prime subscriptions. There is also a 24/7 pharmacist contact system in the service to get all the information about medicines.

Anche se da indiscrezioni pare che i risultati economici siano al di sotto delle attese, le ambizioni sono importanti: da qualche mese Amazon ha cominciato a proporre la propria app di teleservizi medici alle aziende americane, perché la utilizzino per i propri dipendenti (negli Usa molte imprese dispongono di programmi e servizi sanitari per il personale interno). Inoltre, riferisce ancora la Cnbc, il gruppo sta cercando di convincere ospedali e assicurazioni perché gestiscano i loro big data con le sue piattaforme di cloud computing. E nel frattempo ha aggiunto nuove applicazioni sanitarie all’assistente vocale Alexa, compreso un tracker per la salute e il fitness chiamato Halo.

La pandemia continua a gonfiare l’e-commerce della farmacia, gli esperti assicurano che la crescita proseguirà anche nel post-emergenza e così si intensificano le pressioni per una liberalizzazione del mercato digitale del farmaco, della quale beneficerebbero i colossi come Amazon oppure eBay ma anche le grandi farmacie.

Nel nostro Paese, il primo vero segnale del nuovo clima risale a metà febbraio: in un’audizione davanti alla commissione Industria del Senato sul nuovo ddl per la concorrenza, il presidente del consorzio Netcomm Roberto Liscia ha presentato un pacchetto di integrazioni al disegno di legge dirette ad agevolare lo sviluppo dell’online. Tra queste, la modifica dell’articolo 112-quater del d.lgs 219/2006 in modo da permettere a farmacie e «di vendere i farmaci (senza ricetta, ndr) anche su siti web intermediari e piattaforme per l’e-commerce». In tal modo, ha spiegato Liscia alla Commissione, «si potrebbero ridurre i costi di transazione e consentire ai venditori l’accesso a una più vasta platea di consumatori».

Netcomm’s request is to make it so that pharmacies and parapharmacies can also sell over-the-counter medicines on Amazon and other “generalist” e-commerce sites, as many pharmacists already do with supplements, nutraceuticals, dermocosmetics, and other nonpharmaceutical references.

Roberto Botto – CEO of Inthezon, Libera Brand Building Group

Note: The contents of this analysis are based on independent evaluations by Inthezon and are not attributable to Amazon or related brands.