The appointment with the online consumption observatory continues, born from the collaboration between Markup and Inthezon, a company specializing in Amazon consulting since 2017 that is part of Libera Brand Building Group, established with the goal of helping brands improve sales performance on Amazon by creating innovative digital shopping experiences.

Each month we address the specific themes of a sector to highlight trends, consumer preferences, market evolutions and opportunities to seize.

The pandemic has had a significant impact on the beauty sector as well. In particular, consumers in 2020 approached e-commerce significantly, both large-scale and small independent ones, some launched in the last year, precisely as a reaction to the closure of points of sale.

Data from the Cosmetica Italia Study Center highlighted in 2020 a growth of the e-commerce channel of +42% for a value close to 710 million euros, compared to an average distribution contraction of almost 10 percentage points. The e-commerce channel with a consumption coverage of 7.3% became the fourth channel for cosmetics distribution.

E-commerce Growth: +42% | Market Value: €710 million | Market Share: 7.3%

This growth contributed to an increasing number of sellers on Amazon.

Certainly, the reopening of professional channels is alleviating consumers’ interest, particularly for “do-it-yourself” products, but the importance of beauty routine, greater attention to natural and sustainable cosmetics, a new sensitivity to the concept of safety, lead to confirming some consumption trends that characterized 2020, but that will also impact the future.

For example, from the beginning of the pandemic, a reduction in purchases of lipsticks and lip cosmetics was recorded. At the same time, customers focused on products that enhance and enhance the look, define the eyebrows, lengthen and strengthen the eyelashes.

During the health emergency, interest in make-up gave way to that for skincare. Fewer cosmetics were sold, but interest around the world of skin care increased. This determined the entry into the market of new products, which perhaps before were relegated to the East.

In this context, Amazon plays a central role because it allows you to have all the best beauty products at your fingertips. The Amazon Beauty category includes everything, from eyeliner to shampoo, from fragrances to accessories.

Amazon Beauty Category Structure

The Amazon Beauty category is structured into several main categories that in turn contain various detailed subcategories to better direct consumers in their choice:

- Makeup and cosmetics: more than 70k results

- Skincare and personal care: more than 70k results

- Hair care products: more than 80k results

- Fragrances and perfumes: more than 20k results

- Beauty accessories and tools: more than 70k results

- Nail care products: more than 60k results

- Professional beauty equipment: more than 100k results

This crowding represents a great opportunity for the consumer, but a complexity for the seller: even if 1,000 additional pages of products to choose from appear, typing a keyword like “anti-wrinkle serum” (17,230 in the Amazon search ranking for the month of June) most buyers will still not search for products beyond the first page.

Every hour Amazon updates the ranking of the best-selling products in the category, the most desired and the most voted and reviewed. Monitoring these Amazon rankings is a window into the beauty industry and consumer interests: what are the most popular products of the moment, which ingredients are most appreciated, and how much does price positioning influence this ranking?

In the Beauty category, more than in others, positive reviews are of central importance, proving decisive for the purchase choice.

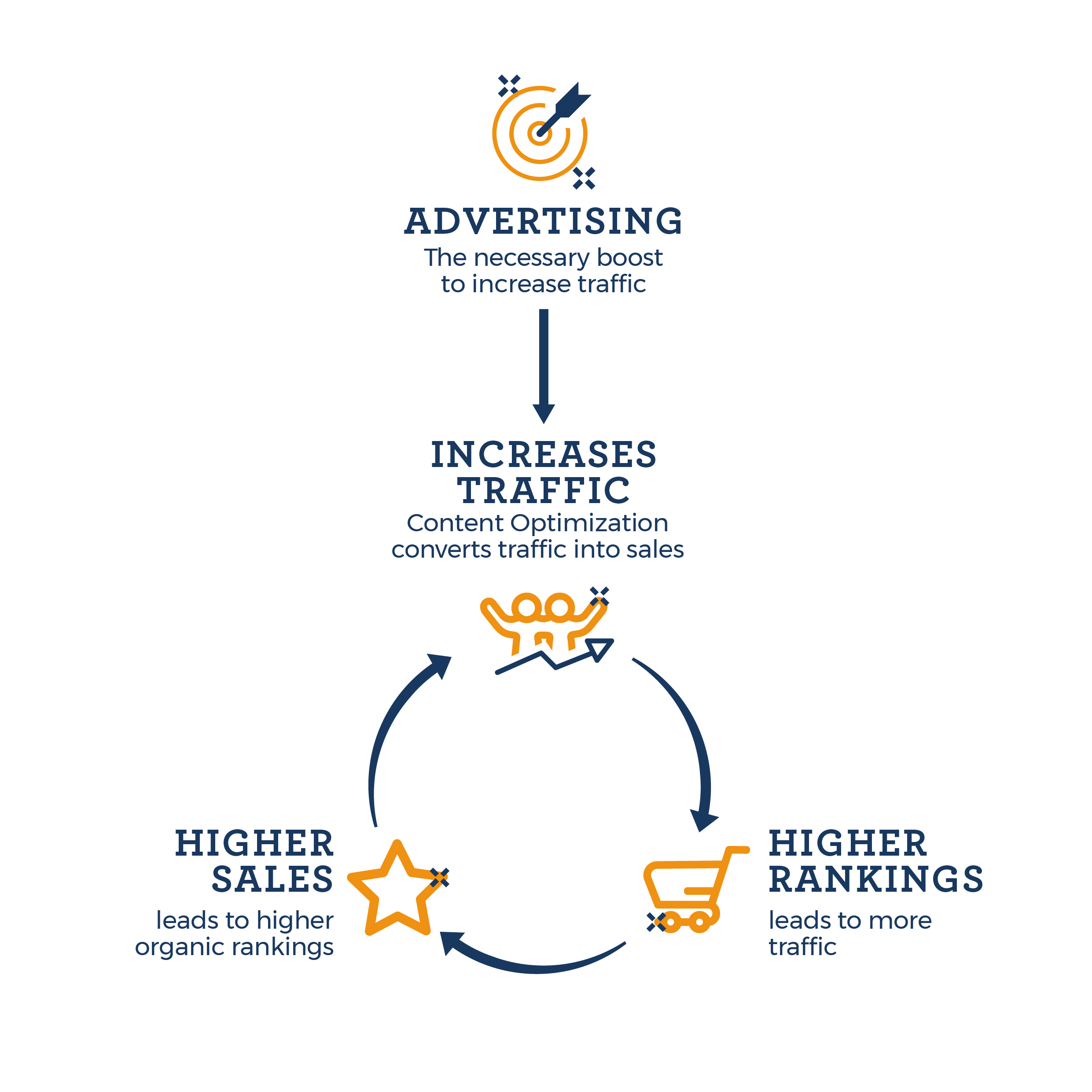

But how to reach this positioning in Amazon’s ranking? Through an approach that includes creating engaging and captivating premium content to increase the conversion rate, and supporting the references with advertising activities to direct traffic towards optimized references, accelerating sales and moving organic ranking.

Prime Day Performance Analysis

On Monday 21 and Tuesday 22 June, online shopping enthusiasts were able to consult the Amazon Italia catalog and save thanks to Prime Day. Within the Beauty category, these were the main search keys:

- Hair straightener => 162 on total amazon.it

- Hair dryer => 708 on total amazon.it

- Semi-permanent nail polish => 219 on total amazon.it

- Curling iron => 551 on total amazon.it

- Men’s perfume => 218 on total amazon.it

These highlight the search for opportunities on objects to give as gifts or with a high price point. While in the total month of June, we see in 3rd position on the category “Australian gold” (509 on total amazon) riding the summer season and tanning.

Amazon is constantly looking for new ways to differentiate its offering and complete the range of services available to its users, beyond the Marketplace. The latest news from recent days is addressed precisely to the beauty segment.

Amazon has in fact opened its first beauty salon in the center of London. Arranged on two floors, called Amazon Salon and covers an area of 140 square meters in the fashionable area of Spitalfields, in the East End of the English capital.

The biggest innovation is the development of an augmented reality app that will allow you to “test” a new haircut or a new color before performing a treatment. To this is added an Amazon Fire tablet available to users for entertainment and the possibility of purchasing all the beauty products present in the store and receiving them directly at home thanks to Amazon’s shop.

Open seven days a week, the service will initially be aimed only at employees, but in the coming weeks it will also be open to the public, by appointment. It is a unique experiment and no openings are planned in other cities.

SEO Strategy and Content Differentiation

Another very important point to emphasize is the need, where Amazon profile and proprietary e-commerce coexist, to differentiate product descriptions. When a user searches Google for keywords related to a product, Google always gives priority to Amazon and this overlap would therefore risk damaging the positioning of e-commerce. No “copy and paste” therefore, yes to dedicated and personalized texts with respect to the reference channel.

Roberto Botto.

Ceo di Inthezon, società di Libera Brand Building Group

Note: the contents of the column are the result of indipendent evaluations by Inthezon and not by Amazon or brands attrobutable to it.