The Italian market for detergents and cleaning products has been in a steady decline since 2011, with a cumulative decline through 2017 of -11%. The most recent time frame, however, has seen slow growth, starting in 2019 with a 0.9% increase in value.

The explosion of COVID-19 has been positive for the market, with all product categories experiencing rapid year-over-year growth between 14% and 18% (Source: Businesscoot)

Hygiene played a key role in daily life during the health emergency period, and after the logical increase in the entire detergent segment in 2020, during the second quarter of 2021, there was a slowdown in FMCG products in the E-commerce channel. This is expected, given the comparison with the exceptional peak reached during the first lockdown last year.

The channel’s development rates, however, remain in positive terrain, and demand is extremely dynamic as it can rely on a wealth of new consumers acquired during the pandemic period.

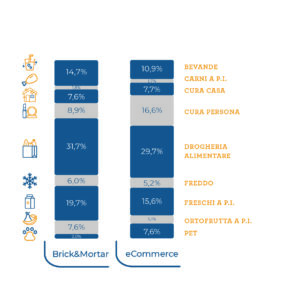

The profile of sales in the second quarter confirms the closeness of FMCG baskets between physical and virtual distribution.

The user base of the virtual is now largely composed of consumers who frequent both channels; as a result, the sales profile tends to become increasingly similar.

This sanctions that the virtual channel is now to all intents and purposes a competitor to physical stores, or rather, it is an important complement to commercial enterprises operating in the physical channel (IRI – E-Commerce in FMCG: what’s new in the second quarter of 2021)

It should not be forgotten that two important elements that characterize the Home Detergence market are product innovation and the gradual migration of supply and demand toward a greener and more environmentally friendly sub-segment.

The digital environment makes it very easy to locate and choose Eco-friendly products.

The search key “ecological detergent” corresponds in Amazon to around 20,000 results, as many as 50,000 to the search key “ecological detergent,” and over 40,000 to the search key “eco detergent.”

The significant aspect to note is that in this category there is space and visibility for leading companies in the sector, but also – and above all – countless brands that use the amazon channel as their main touchpoint to reach their customers, accompanying their product sheets with detailed information (A+ Pages) and presenting their specificities through Brand Stores – true product showcases, which offer themselves to the user as informative mini-sites.

The growth of online and the emergence of new trends has also led to a significant change in purchasing habits for the detergent segment, with less frequent spending, a higher average receipt and less and less “feminine” spending, and is highlighting a trend toward the purchase of multipacks: for the convenience of cost, for the convenience of receiving the stock directly at home, and in the case of eco products for the lower environmental impact of packaging.

And it is in the direction of sustainability and multipacks that we expect to see significant growth in the coming months.

Roberto Botto. Ceo di Inthezon, società di Libera Brand Building Group

Note: The content of this analysis represents independent evaluations by Inthezon and not by Amazon or brands associated with it.